End of FINANCIAL YEAR Review: The Australian Economy in 2022–23

Here we are, it’s midway through the year already and I thought it would be time to look at how the economy is going.

At the start of the year, everyone was worried about inflation and interest rates and not much has changed. Although I feel like the inflation issue is going to be vastly different by the end of the year – I’ll come back to this later on.

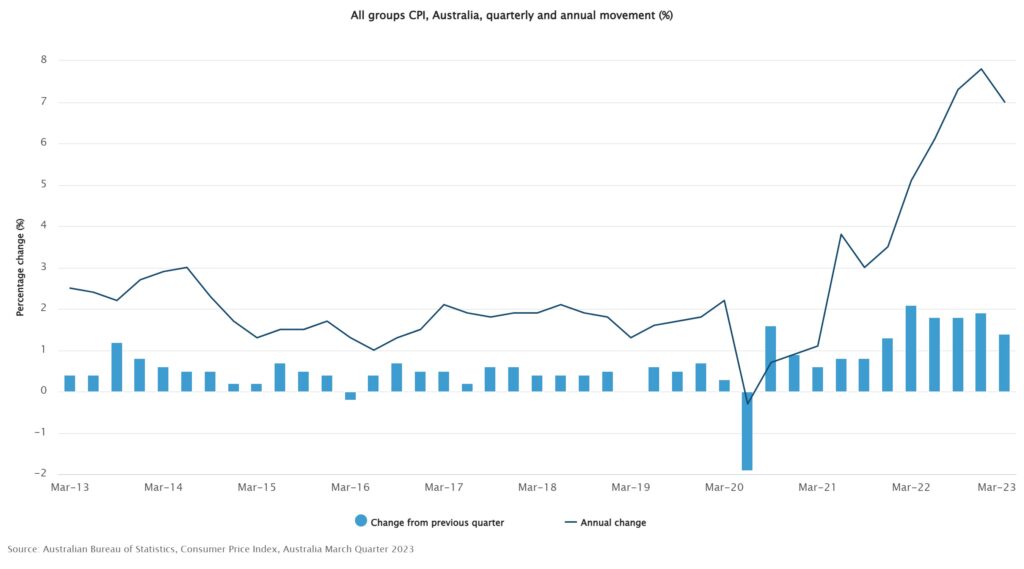

With inflation it’s looking like we’ve gone through the worst of it although just because it’s headed down that still means prices are continuing to go up. It just means that thing wont go up in price as fast as they were 6 months ago.

Shall I enter the property market now?

Know your options for your property investment loans. Talk to our expert Mortgage Broker.

BOOK A FREE 15-MIN CONSULATION NOW

Australia’s Consumer Price Index

People are really feeling it when they do the weekly shop or pay the electricity bill or pay $2 a litre at the bowser.

Added to that Phil Lowe and friends down at The RBA are continuing to raise interest rates.

They want to beat inflation down into the ground. Unfortunately that means a lot more pain for the average person in the form of increased interest rates.

So in that respect – it’s been more of the same.

What’s new is the growing debt our governments have.

Really it’s not new, it’s just been that the media has been putting other things in front of us – to learn more you can check out the video I did on Victoria’s debt.

I did that video before Dan Andrews decided to give free TAFE for all. They have seriously lost the plot and think that foreign students are going to pay our debts back.

The debt was increasing before the pandemic hit and now it’s accelerating

The state is cooked and the growing debt is going to become an issue in the years to come.

We also have two other problems, productivity and housing.

Before I get onto housing I want to touch on productivity because it is totally ignored.

On Productivity

What happens when you create a lot of money which is what happens when rates drop to 2% and governments borrow so much money – is that you divorce a dollar from its value.

Less work got done because many of us were locked inside for the best part of two years. At the same time, we created 20-30% more money.

The obvious outcome is inflation. But there are second-order problems we are now facing.

You have record low unemployment.

You have workers that have a high amount of rights so they can decide to be lazy if they want. Who can blame them, the world we’re living in doesn’t really incentivize any one to work hard to get ahead.

On the other side, if they get sacked they can just get a job probably for more pay somewhere else because there’s such a labor shortage.

There’s not enough work getting done to earn the money to pay the debt back.

Australia’s Housing Crisis

The writing’s been on the wall for housing for several years for the housing market and it’s multi faceted.

You have house prices in general. Nothing including a pandemic and lock downs have been able to put a dint in it.

You have not enough houses and skyrocketing rents leaving more and more on the bread line.

You also have the issues for all the builders operating profitably without going bankrupt.

None of this has changed. All of this has exacerbated.

I feel like in the last 6 months not much has changed. We had that month were the RBA paused the interest rate rises and then everyone breathed a sigh of relief.

Then they changed their minds again and we’ve had another 2 rate rises since.

Inflation Rate in Australia

I want to note something about the inflation on this End of Financial Year Review – it’s not as if people are out there buying all the beers for example and they cant brew the fast enough to keep up with demand.

The increases are coming from the supply side. The small businesses are raising prices to stay afloat but the big guys are still making big profits.

This is where we circle back to that printing of all the money. It’s decreased the unemployment rate so far and unfortunately we need that to crack.

We cant have record low unemployment and fix the inflation problem. At some point businesses will raise costs to the point where people stop spending. When people stop spending businesses stop earning and they have to start letting go of workers.

Whilst this first half of 2023 hasn’t seen too much development in the economy I feel like the second half is going to be totally different.

We are starting to see the signs of money being taken out of the economy. This is the effect of higher interest rates. In the US the inflation is dropping and it’s dropping at a rapid rate.

Usually what happens there is a good bellwether for the rest of the global economy.

As for inflation in Australia, it’s turned but it’s still too early to confirm if it’s trending down.

If it is trending down then the narrative in the media is going to change completely in the coming months and to be honest I think most of us understand there’s more pain to come and we just want to get it over with.

Let’s see what the rest of 2023 hold’s for us.

Mortgage Broker Frankston, VIC

Will Bell has 15 years’ experience in the finance industry, the last 12 years he has owned and operated Will Bell Mortgage Broker. He specializes in residential home loans and over the years has carved out a trusted brand. This is proven by the reviews his customers have made regarding the service and the experience he has provided.

YOU MIGHT BE INTERESTED IN THESE BLOGS:

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.