I thought I’d probably have another quick video seeing what we had at the budget last night. I know it’s really enthralling news for you guys, so I won’t keep it too heavy for you.

Again, the rundown is home loans property, and some news about the broader economy. Home loan news – budget announcements. So a couple of big announcements for single parents and first home owners.

So you might have heard the single parent one, which has been announced a little bit over the past couple of days, you can get in the property market with basically no deposit – 2% is what they are doing. The idea is for single parents to get in the market where they couldn’t have done so before.

This is something new that they’ve thought up and a new little scheme to add to all the other current schemes. So on top of that, what they’ve done is they’ve extended a couple of the other schemes. They announced under the first home loan deposit scheme, and additional 10,000 spots for newer established homes. That’s pretty big news in terms of the budget, because it’s going to push the housing market quite a fair way.

The second home loan news is long delays in home loan application. This is probably pretty important to you if you’re looking to purchase, say in the next three or six months, because some of the larger banks, by some I mean all of the larger banks are actually taking up to two months, I’ve had applications that’s taken three months to approve. So you need to get in early, you need to make a plan.

Fortunately for most people, they don’t need to go to a big for bank, there’s other options out there that are just as good and you don’t pay over the moon for them.

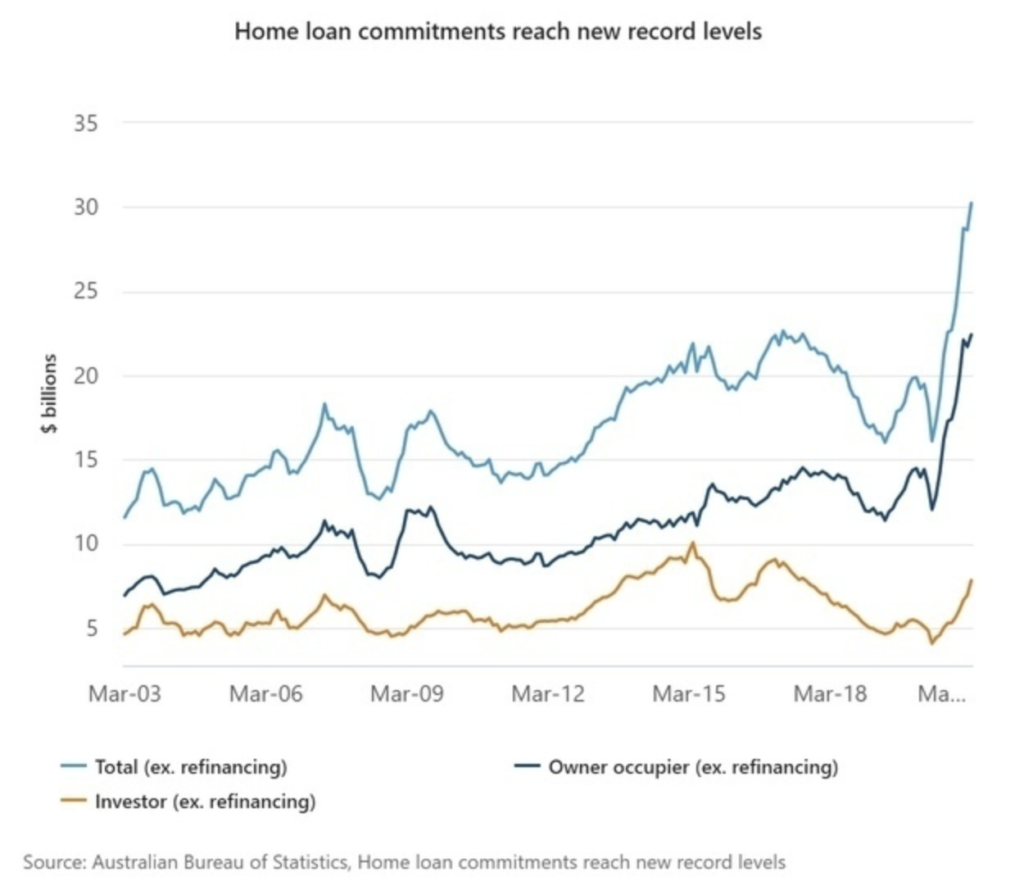

Property market news, record home loan commitments, which shouldn’t come as a shock to anyone based on the based on kind of the rhetoric in the news the last few months. But what I thought I’d do is show you is pretty little graph view, which kind of tells you a lot about the situation.

So obviously, this big spike here is coming out of the pandemic and people borrowing which is telling you the housing market is already going up.

First home owner benefits to push the market, we don’t really need to go any more into that. I did want to push something, though. And this is what I always say is that when an economy looks weak, or the property market looks weak, you could say that as well, governments don’t just let these things fall over, they always think of things to put in place to push the market.

Especially in Australia, the property market because a lot of politicians think the property market is all of the markets, which is the economy. So this is why I was saying all through the pandemic, the property market isn’t going to drop, they’re going to backstop this and they’re gonna throw everything at it. And this is just a part of that. So expect probably process to continue to go up in the future.

The one caveat to that, I would say is to expect volatility in the economy in general. So we might have six months where things don’t look too good. But then they’ll bring out some new whiz bang scheme and all of a sudden the economy will be off to the races and we’ll be rich again.

That leads us into the broader economic news. I’ve got an article here that reckons Aussie’s still think they will spend big. So if we look at that. That’s an article from ABC basically saying they think they’re going to turbocharge the economy and get a lot of spending going. Which is fine. The problem there is that if they just get spending going from the handouts they’ve given, then the spending is going to stop unless they keep on handing out money.

The only way they’ll get continued spending is if the money that it is printed – if the stimulus creates wages growth.

So the problem with that is they’ve been trying to create wages growth for the last 10 years, and that’s why they won’t get inflation. So if you actually look back at the Reserve Bank’s target inflation for the next financial year, for the last eight or nine years, they’ve been out by 1 or 2%. And it’s because they cannot get these wages to rise.

So they’re still doing the same thing. The economy might look good, but I think if you look at it in a three year patch, I think what will happen is that it will look good, and then the honeymoon will be over. And the government will be forced to keep on creating money and providing stimulus to the system, which ultimately doesn’t actually recover the system unless they’re boosting wages, which is why they’ve been harping on for 10 years that they want to boost wages.

Unfortunately, they haven’t hit that target. And what’s actually happened is that all of this money creation, all of this stimulus, all of this money printing, basically, it’s just it just made asset prices increase.

This article here, from the AFR is actually about the super style scheme for home buyers. So I actually just wanted to touch on that as well. And just to give people a bit of an understanding of how these guys use the budget to kind of push things to make themselves look good.

These super schemes actually have been around for about four years. Unfortunately, no one’s used it. And have honestly had two people ask me about this in four years. And the reason I think that it doesn’t work is because people don’t trust super, but especially people under 40.

You know, that I think government’s helping them very much at all. But yeah, it’s just interesting how they use these things to make themselves look good. And to blow their trumpet when, you know, it’s not hasn’t been working for the last three years. And, you know, we just throw more money at it will just, you know, we just make it look better, but have it not work.

And speaking of things not working, I just want to finish off with this one, which is financial planning isn’t working for poor people, I would say the basic level of planning you need is for most people to have things in place like income protection and life insurance and stuff like that. I would say 90% of people don’t take it out.

Unfortunately, the odds of you having an event. By event I mean, some sort of medical thing where you can’t work for at least a couple of months between now and when you retire. Unfortunately, those odds are quite high. So this is a big problem that Australia is going to have in the future because if people don’t have adequate insurance, now, they actually end up on the taxpayers payroll, because we’ve got to pay all their disability pensions and stuff like that.

I just wanted to touch on that as well because government’s have put their paws on the financial planning industry in recent years, which was fair enough, actually, they. It was a dodgy industry, people were dodging everything. Unfortunately, they’ve changed it. And there’s definitely not going to be any better outcome but it’s probably going to be a worse outcome coming down the line.

That’s it for me today, and if you want to chat further please don’t hesitate to reach out.