VICTORIA BUDGET ANNOUNCEMENT 2023-2024

The Victoria Budget Announcement 2023-2024 was all over the media and surprise surprise, there’s a massive black hole of debt.

The state government have been talking up their big plan to pay their $31B COVID borrowings back, all the while hiding the fact that the state is still going backwards.

Worried about the rising interest rates?

Know your options for your home loan. Talk to our expert Mortgage Broker.

BOOK A FREE 15-MIN CONSULATION NOWVictoria Budget Announcement 2023-24

Global ratings agency Standard & Poor predicts that by 2025 Victoria will hit peak debt of $194B.

Despite this, the state government are putting on a brave face and selling in their own numbers:

Source: The Guardian

I feel like I should highlight something for the average viewer here. It’s this blind spot that Australians are really bad at – and that is talking and thinking about numbers.

In my 15 years’ experience in finance I can tell you there is a lot of people out there that as soon as you start talking figures their minds start going blank – hand on heart I’ve seen people’s eye’s glaze over – this is common.

A real life example of this happening is when I say in conversation that most people don’t actually know what money is. It’s as if it’s some hypnotist trick where they put you into a trance then tell you what they want you to hear.

Let’s talk about the COVID Repayment Plan because it’s a great example of political parties selling a story, and that story is that our economic woes are because of the pandemic.

10-Year COVID Repayment Plan

Data shows that the Victorian government spent big over COVID more than any other state by a country mile.

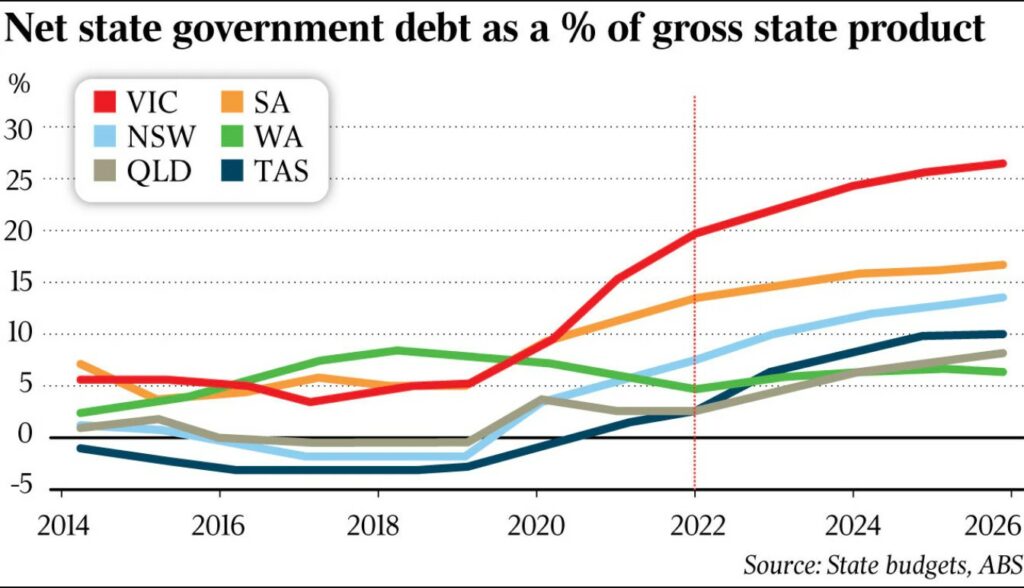

Prior to the pandemic, Victoria was at the same government debt to GDP as South Australia. GDP is just the total amount of income the state earns. Victoria and SA were both around 9%.

By the end of 2022 Victoria was now up to 20% and SA was only at about 14% and if you look at the forecast to 2026 Victoria’s debt is increasing faster than the rest of the states.

Tell me the story about the COVID payback plan again?

This data really confused me. I thought to myself how is the debt still going up and projected by then to be topping in 2026?

I mean, I know there’s a lot of infrastructure spending still to be done as our record amount of infrastructure construction will take time to complete but surely most of that money was spent during the lockdown years.

It turns out finding pretty important information isn’t as easy as you think.

After a bit searching, I found Victoria’s books to try and get some better level of understanding.

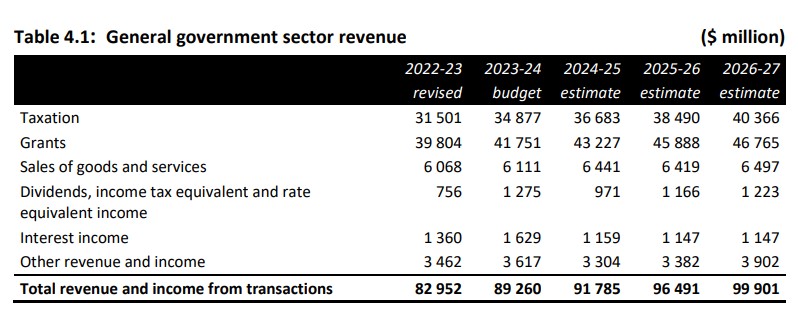

Victoria’s budgeted projected income for the next financial year is $89 Billion.

The projection for the 26-27 financial year is $100 Billion.

Let me unmagic this for you. If you take our budgeted figure for this year of $89B and assume 4% inflation, it will tell you that we are earning $100B. So basically at that level of inflation, Victoria as a state isn’t actually earning anything extra.

Things will be harder as the expenses which are higher than the income will have the same inflation effect.

Throw on top of this our climbing interest bill on our increasing debt. Back in late 2020, S&P Global ratings slashed Victoria’s state government credit rating from AAA to AA meaning that the state is less creditworthy and therefore must pay a higher interest rate on its debt.

There’s no doubt Victoria is going backwards as an economy. This is what governments won’t tell you. The scary thing is it’s not just backwards for a year — it’s backwards for 4 years.

Victoria on Wage Increase

I want to stop here and clarify something because it strikes at the heart of everything. There is no plan to increase the amount of income we are earning. This is on a government level but also generalisation for the average individual level.

If there is no plan to increase the level of income, it’s very hard to recover from a bad position.

When you think about it, what does Victoria actually sell? Where does it make it’s money? There is no plan, not from the current government or the opposition the nearest thing to a plan is to flood our universities with foreign students.

The other thing that’s noticeable is the borrowing.

It just keeps going up. If you as an individual or a family are spending more than what they earn every year for years then that is a problem.

Victoria is living beyond its means and has no plan to increase the income.

A very basic cycle of prosperity:

- We have economic cycles because of debt

- Borrowing is taking future gains and bringing it forward to buy something

- Out of that stuff that is bought there should be enough income created that pay’s back the debt plus the interest

- When that doesn’t happen people stop spending. One person’s spending is another person’s income. And the cycle starts moving down.

The coming years are unlikely to be as easy as the previous couple of decades. The reason I make these is so that people will take more responsibility for their own finances because the government isn’t going to come in and save the day.

You can start by putting good people who are experts in finance around you. If you want to do that you can get in contact with us using the links below.

Mortgage Broker Frankston, VIC

Will Bell has 15 years’ experience in the finance industry, the last 12 years he has owned and operated Will Bell Mortgage Broker. He specializes in residential home loans and over the years has carved out a trusted brand. This is proven by the reviews his customers have made regarding the service and the experience he has provided.

YOU MIGHT BE INTERESTED IN THESE BLOGS:

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.